Frequently Asked Questions

What makes VolumeLeaders different from traditional order-flow tools?

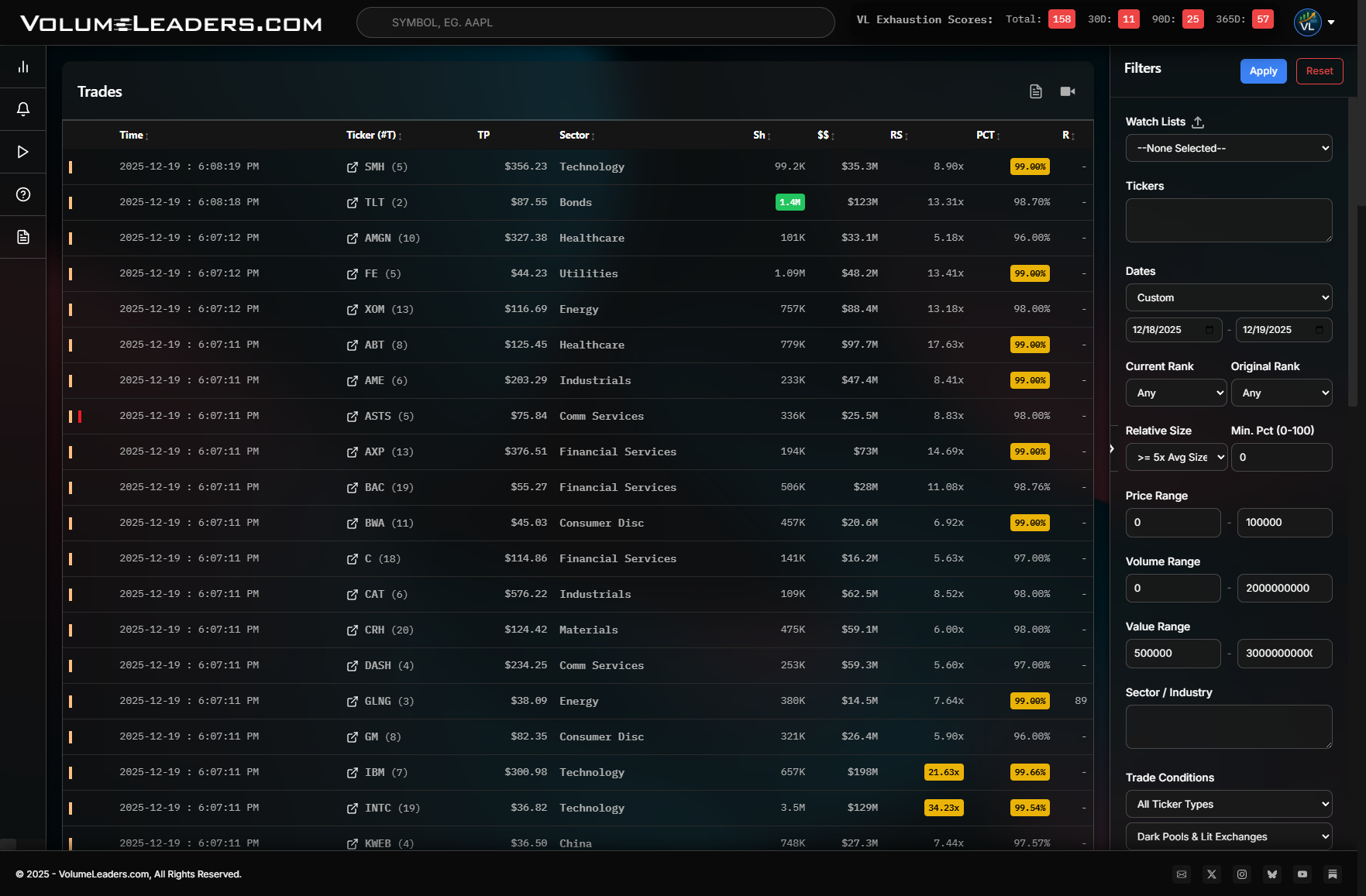

Most order-flow platforms show you every "large print" (i.e. $1M+ trades), regardless of other significant factors like unerlying liquidity, average daily volume, frequency of trade size and more. VolumeLeaders does the opposite: it filters out the noise and surfaces only statistically significant institutional activity — the trades with a proven history. Instead of giving you more data to interpret, VL gives you more context and clarity around more significant trade events so that you can make more informed decisions.

How does VolumeLeaders determine which trades are actually important?

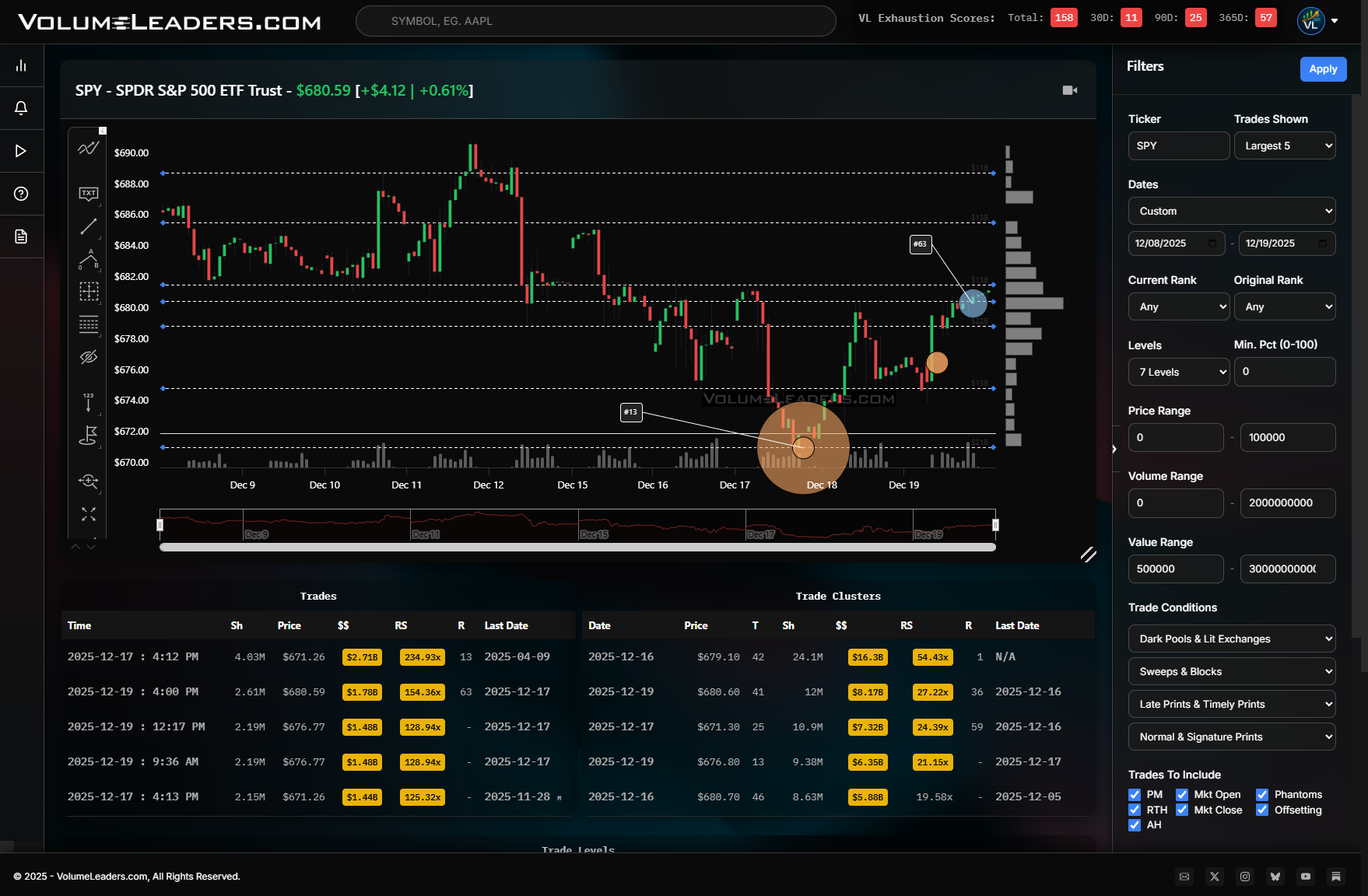

Size alone is not a signal. VL evaluates every trade across every ticker and evaluates it relative to a ticker’s historical behavior, sector norms, liquidity profile, and multi-year activity. A “large” trade in SPY might be totally routine, while a smaller trade in a mid-cap could be statistically enormous. VL calculates rarity, magnitude, frequency, historical impact and more so you instantly know whether a trade is meaningful, unusual, or irrelevant.

Can VolumeLeaders help me avoid false breakouts or fakeouts?

Yes — one of the most important factors when trading is identifying who is in control. VL shows you when real money is involved and a name is garnering institutional attention. This helps you avoid chasing names without institutional conviction and getting trapped on the wrong side of a move. By monitoring institutional participation, you can stay aligned with the side that actually moves markets.

Does this work for day trading, swing trading, or longer-term investing?

All three. Day traders use VL to track short-term institutional pressure, phantom prints, and short-term institutional behavior tactically expressed through leveraged products and "surrogates" (assets with extremely high correlations to other products).

Swing traders use it to identify sponsored names, levels that attract repeated institutional flow, and multi-session accumulation.

Long-term investors use VL to spot early institutional interest in new trends, themes, and rotation.

The underlying signals come from structural behavior, so they scale naturally across time frames.

Does VolumeLeaders work in volatile markets?

Yes — VolumeLeaders works across all market regimes.

Because VL tracks institutional intent, not chart patterns or surface-level volume, it remains reliable whether the market is trending, chopping, melting up, or melting down. Institutions behave differently in each environment, and VL captures those behavioral shifts in real time.

You’ll see when bearish leverage spikes at the highs, when quiet thematics suddenly heat up, and when large prints appear ahead of major news events — something that happens far more often than most traders realize. VL routinely flags sponsored names that go on to show relentless relative strength during market wobble, and it highlights obscure tickers that institutions quietly accumulate long before they enter the mainstream narrative.

Whether you’re looking for tactical positioning, rotations, relative-strength leaders, or longer-term structural accumulation, VL gives you an objective, data-driven read on what the most influential market participants are doing — even when the broader market is in chaos and sentiment is swinging wildly.

It’s a stock-picker’s dream tool, but it’s just as valuable for self-directed investors, allocators, family offices, and funds. Anyone responsible for capital can use VL to see where real money is flowing day-to-day and over the long run — regardless of the regime.

What are dark pools and why are they important?

Dark pools are private trading venues where institutions execute large orders without revealing their size or impacting the market. These prints often show up off-exchange, sometimes at prices the public market never touched — signals most traders never see. Dark-pool activity can reveal accumulation, distribution, hidden positioning, and short-term intent. VolumeLeaders detects these prints instantly, classifies them, and provides the context you need to understand their significance.

Why haven’t I seen data like this anywhere else?

Because most platforms track retail-visible activity and treat all large prints the same. They don’t quantify rarity, cluster fragmented orders, analyze dark-pool anomalies, or map two decades of institutional levels. VL was built from the ground up to decode institutional behavior — not just display volume. The result is a view of the market that simply isn’t available through traditional charting tools, scanners, or retail-level order-flow platforms. The storage and compute requirements are massive and the data is prohibitively expensive; as a matter of fact, most

other platforms claiming they track institutional activity or "whales" are only tapping into a few exchanges and delivering their customers a fraction of the data and detail you get with VolumeLeaders.

What if I try the platform and don't like it?

There’s no lock-in, no contracts, and no pressure. If VolumeLeaders isn’t a good fit, you can cancel at any time — we’re not interested in keeping anyone’s money if they’re not getting real value from what we’ve built.

We’re people, not a mega-corp, and we care about making sure every subscriber is extracting more from the platform than they put in. If something isn’t working for you, we’d genuinely appreciate a conversation to understand why, but we will never make it difficult for you to leave. Your trust is far more important than a subscription.

Try it, explore it, ask questions — and if it’s not the right tool for your workflow, you can walk away freely.

.svg.png)